航数 | CA DATA

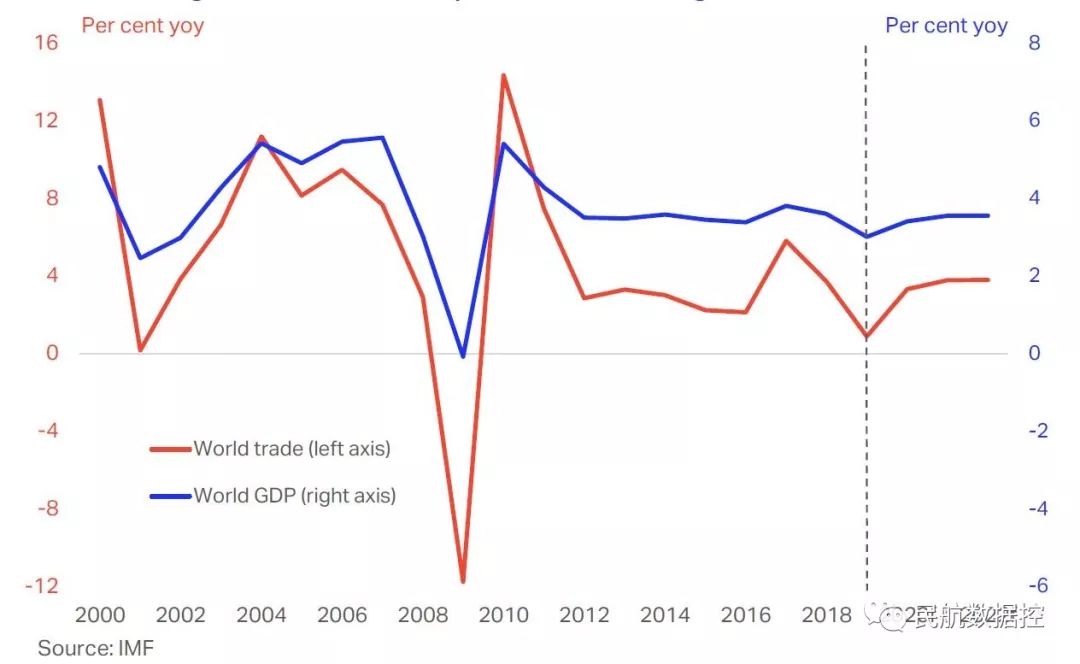

Last week, the IMF released its latest global economic forecasts. 2019 has proven to be a challenging year for airlines, with signs of a broad-based slowing in global economic activity, declining world trade volumes and various political and geopolitical tensions across the regions. This backdrop has been reflected in industry-wide outcomes for both traffic (passenger and, especially, cargo) and profitability. It is unsurprising therefore to see the IMF downgrade its April forecasts for 2019 to a modest global GDP growth rate of just 3.0% and an even more subdued 0.9% pace for world trade volumes. If correct, both of these outcomes would be the weakest since the global financial crisis of 2009, as today’s chart shows. On a more positive note, looking ahead, the IMF expects that economic activity will lift to 3.4% in 2020, notwithstanding an expected slowdown in both China and the US. For trade, the news is similarly positive, with forecast growth picking up to 3.3%. Having said that, the IMF is clear that the risks to this economic and trade outlook remain tilted firmly to the downside, noting that the global outlook remains ‘precarious’. As we have noted previously, there has been a recent trend of successive downward revisions to the IMF’s global outlook. But even so, if the IMF has at least got the direction of their forecast right, this suggests that – barring any unforeseen (and unforecastable) shocks – 2020 (and beyond) is likely to present a more favourable business backdrop for the air transport industry overall than 2019 has delivered.

Last week, the IMF released its latest global economic forecasts. 2019 has proven to be a challenging year for airlines, with signs of a broad-based slowing in global economic activity, declining world trade volumes and various political and geopolitical tensions across the regions. This backdrop has been reflected in industry-wide outcomes for both traffic (passenger and, especially, cargo) and profitability. It is unsurprising therefore to see the IMF downgrade its April forecasts for 2019 to a modest global GDP growth rate of just 3.0% and an even more subdued 0.9% pace for world trade volumes. If correct, both of these outcomes would be the weakest since the global financial crisis of 2009, as today’s chart shows. ? On a more positive note, looking ahead, the IMF expects that economic activity will lift to 3.4% in 2020, notwithstanding an expected slowdown in both China and the US. For trade, the news is similarly positive, with forecast growth picking up to 3.3%. Having said that, the IMF is clear that the risks to this economic and trade outlook remain tilted firmly to the downside, noting that the global outlook remains ‘precarious’. ? As we have noted previously, there has been a recent trend of successive downward revisions to the IMF’s global outlook. But even so, if the IMF has at least got the direction of their forecast right, this suggests that – barring any unforeseen (and unforecastable) shocks – 2020 (and beyond) is likely to present a more favourable business backdrop for the air transport industry overall than 2019 has delivered.

2019年9月25日起,民航数据控推送仅会保留一段时间,感兴趣的朋友请勿错过。

过往历史推送民航数据控已撤回。

航数 | CA DATA 这里有最专业的分析与最好玩的新闻。同时推动中国民航健康发展。

邮箱:minhangshujukong@163.com

欢迎转发,如转载民航数据控的文章